Condo Insurance in and around Fresno

Condo unitowners of Fresno, State Farm has you covered.

Quality coverage for your condo and belongings inside

- Fresno

- Clovis

- Madera

- Kingsburg

- Selma

- Mendota

- Firebaugh

- Dos Palos

- Chowchilla

- Madera Ranchos

- Coarsegold

- La Grande

- Visalia

- Hanford

- Easton

- San Jose

- Merced

- Atwater

- Morgan Hill

- Gilroy

- Saratoga

- Sanger

- Lemoore

- Laton

There’s No Place Like Home

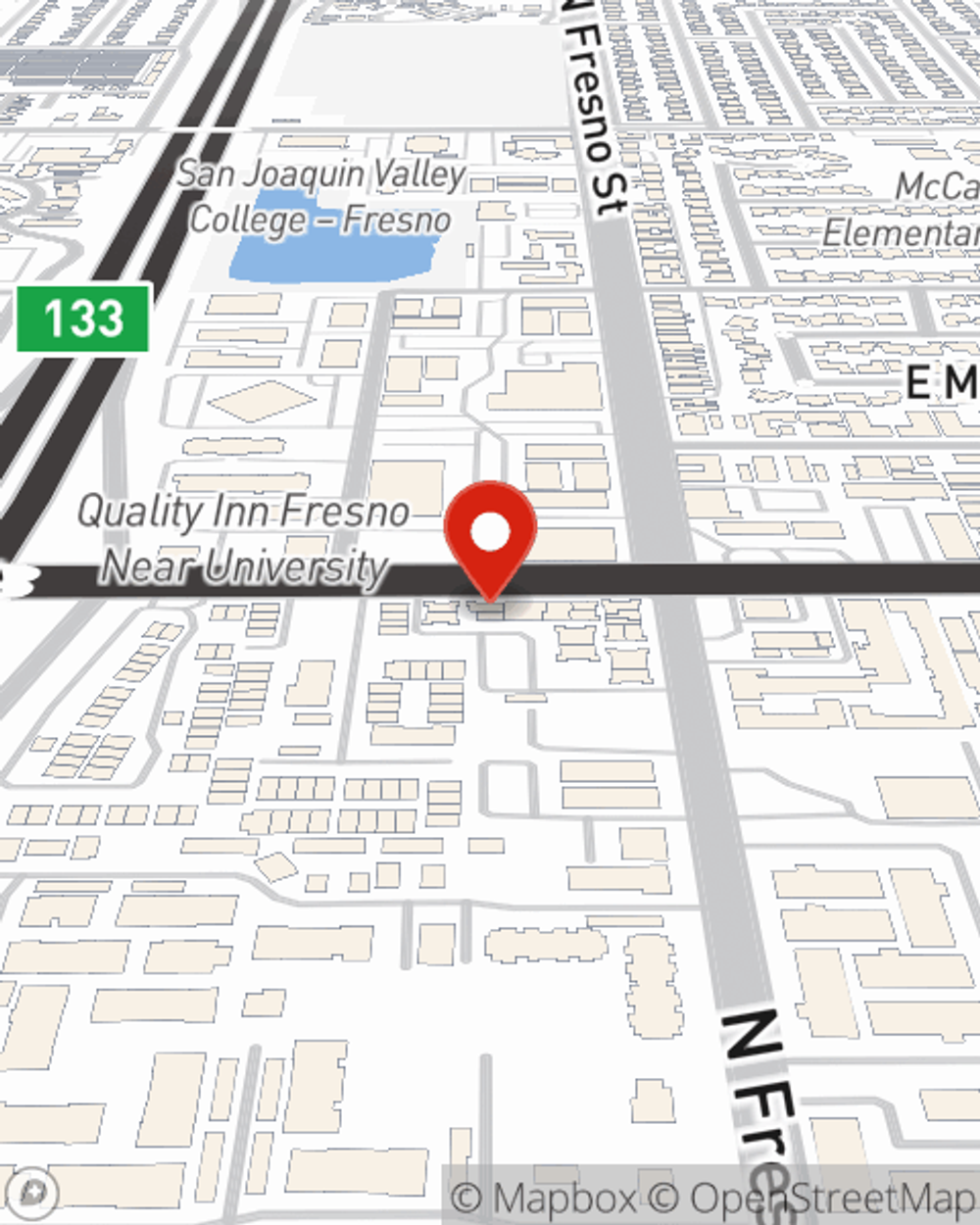

There are plenty of choices for condo unitowners insurance in Fresno. Sorting through deductibles and coverage options is a lot to deal with. But if you want budget friendly condo unitowners insurance, choose State Farm for covering your condo and personal belongings. Your friends and neighbors in Fresno enjoy remarkable value and straightforward service by working with State Farm Agent Chris Souza. That’s because Chris Souza can walk you through the whole insurance process, step by step, to help ensure you have coverage for your condo as well as souvenirs, furniture, sports equipment, clothing, and more!

Condo unitowners of Fresno, State Farm has you covered.

Quality coverage for your condo and belongings inside

Condo Coverage Options To Fit Your Needs

Everyone knows having condominium unitowners insurance is essential in case of a ice storm, blizzard or fire. Sufficient condo unitowners insurance lets you know that you condo can be rebuilt, so you aren’t left with the bill for a home that isn’t habitable. One important part of condo unitowners insurance is that it also covers you in certain legal cases. If someone has an accident on your property, you could be required to pay for the cost of their recovery or their hospital bills. With adequate condo coverage, you have liability protection in the event of a covered claim.

Intrigued? Agent Chris Souza can help you understand your options so you can choose the right level of coverage. Simply visit today to get started!

Have More Questions About Condo Unitowners Insurance?

Call Chris at (559) 439-5338 or visit our FAQ page.

Simple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Chris Souza

State Farm® Insurance AgentSimple Insights®

Do you need earthquake insurance if you don't live on the coast?

Do you need earthquake insurance if you don't live on the coast?

According to USGS, various U.S. locations have experienced earthquakes of magnitude four or more in recent years. Earthquake insurance can be valuable to all homeowners.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.